Periodic Auctions Book

Intra-Day Auctions

Periodic Auctions Book

Lit Book Dedicated to Intra-Day Auctions

The Periodic Auctions book provides a reliable place to execute orders within the Cboe EBBO (in most cases calculated using Cboe’s BXE and CXE order books, the primary market and Turquoise) on BXE and within the Cboe EBBO plus 1 tick on DXE. This lit order book is characterised by a true price formation mechanism and execution allocation that prioritises larger orders.

Cboe’s Periodic Auctions book is a MiFID II compliant lit order book providing pre-trade transparency, as stipulated by MiFID II in accordance with RTS 1, by publishing price and indicative execution quantity of the order book prior to executing orders.

Visit the Periodic Auctions Book Resource page here.

How It Works

Order Type

What orders are accepted?

- Limit Order

- Market Order

- Mid-EBBO Pegged Order

Can different order types match?

- All order types can match against any other order type

- Buy and sell orders are submitted individually and separately. There is no ability to submit a pair of orders.

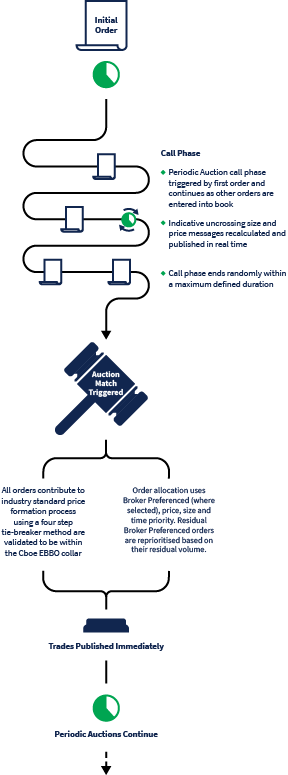

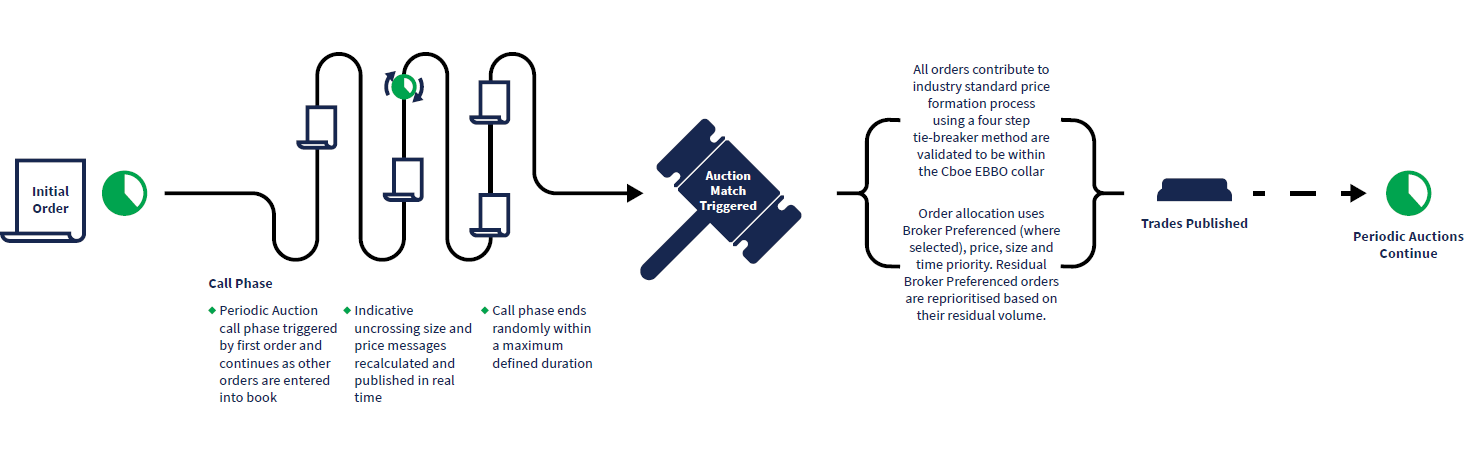

Call Phase

When does the call phase start and end?

- It commences upon receipt of the first order and continues as other orders are entered into the book

- It ends randomly within a maximum defined duration

- The maximum duration of an auction is 100ms

What steps are taken to ensure orderly markets?

- Auction call durations are randomised

- There is no known minimum duration to deter those looking for liquidity information without risk of execution

Pre-Trade Transparency

What is shown on the market data feed?

- During the Call Phase, indicative uncrossing size and price messages

- Follows RTS 1 for pre-trade transparency for periodic auctions

- The trades are published immediately post-auction match

How often is a message published to the market data feed?

- Size and price messages are published in real time

True Price Formation

When does the price formation process occur?

- It begins immediately when the call phase ends and occurs every time there is an order book event

Which orders does it apply to?

- All orders in the order book contribute to the industry standard price formation process

How does the price formation process work?

- The match price is chosen using a four step tie-breaker process. The price does not default to mid-point reference.

- Orders can trade at any price up to their limit price

- The price is checked to be within the EBBO collar to maintain orderly markets (and within the Cboe EBBO plus 1 tick on DXE)

What are the criteria and the sequence?

- Maximum executable volume

- Minimum surplus

- Market pressure

- Reference price

For more details on each step, please read our Guidance Note.

Allocation

How are orders allocated?

- Order allocation uses Broker Preferenced (where selected), price, size and time priority in that order

- Residual from Broker Preferenced orders is reprioritised based on their residual volume

- The Broker Preferenced feature is optional and refers to single broker paired transactions

Sweep Orders

The Periodic Auctions Book (PAB) can be accessed via Cboe’s sweep order types, which are designed to be a simple solution for Participants to access multiple Cboe order books via a single order. These order types include: PAB Lit Sweep, Dark PAB Lit Sweep and Dark PAB Sweep. These orders allow Participants to target price improvement opportunities in the PAB and Dark Books before sweeping the local Lit book.

For more information, visit the Periodic Auctions resources page hereIt's as Easy as a FIX Tag to Participate

Existing Participants connected to BXE and DXE can enter orders into the book by simply using FIX tag 9303=BP. Participants can leverage the same clearing arrangements, connectivity and FIX or BOE ports for order entry for the Periodic Auctions book.

Metrics Behind Matches

We provide transparency into the data behind our Periodic Auctions book by posting statistics for broker priority allocations. The following table shows the Cboe Europe Equities percentage of broker priority allocations.

| Cboe NL | Cboe UK | |

| 2019 | N/A | 22.5% |

| 2020 | N/A | 18.7% |

| 2021 | 18.5% | 18% |

| 2022 | 17.7% | 15.4% |

| 2023 | 15.4% | 13.5% |