Cboe’s VPD, SPEN, CALD and SPRO Indices Gained More Than 22% Over 12 Months

This Index Insights Monthly Scorecard provides an update on the performance of indices that track the levels of volatility or the performance of hypothetical strategies that invest in options or futures.

Highlights:

- These Cboe indices gained more than 22% over the last 12 months: Cboe VIX Premium Strategy Index (VPDSM), Cboe S&P 500 Enhanced Growth Index Series (SPENSM), Cboe Validus S&P 500 Dynamic Call BuyWrite Index (CALDSM), and Cboe S&P 500 Buffer Protect Index Balanced Series (SPROSM).

- New volatility indices - Cboe MSCI Emerging Markets Volatility Index (VXMXEFSM) and the Cboe MSCI EAFE Volatility Index (VXMXEASM) – provide gauges for global equity volatility. In early 2020 the VXMXEA Index rose from 8.81 on January 20, to 65.76 on March 16, an increase of 646%.

Gains for Cboe’s VPD, SPEN, CALD and SPRO Indices

Cboe Global Indices provides dozens of strategy indices that track the levels of volatility or the performance of hypothetical strategies that invest in options or futures. The table below shows the returns for 21 of these strategy indices and four of Cboe’s volatility indices.

Source: Cboe Global Indices

Over the past 12 calendar months the Cboe VPD Index gained 38.5%, followed by 27.6% for Cboe SPEN Index, 24% for Cboe CALD Index and 23% for Cboe SPRO Index.

Source: Cboe Global Markets

New Gauges for Global Equity Volatility

Cboe recently introduced new indices to measure the 30-day expected volatility of the MSCI EAFE® Index (MXEASM) and MSCI Emerging Markets Index (MXEFSM).

In collaboration with MSCI, these indices were developed using Cboe's proprietary VIX® Index methodology, and are based on existing MSCI EAFE Index Options (MXEA) and MSCI Emerging Markets Index Options (MXEF). They are designed to provide a transparent measure of the market's expectation of 30-day implied volatility by these respective MSCI index option classes. Similar to the VIX Index, which is designed to reflect investors' consensus view of future (30-day) expected U.S. stock market volatility, the new Cboe MSCI Volatility Indices aim to provide comparable measures for international and emerging equity market volatility.

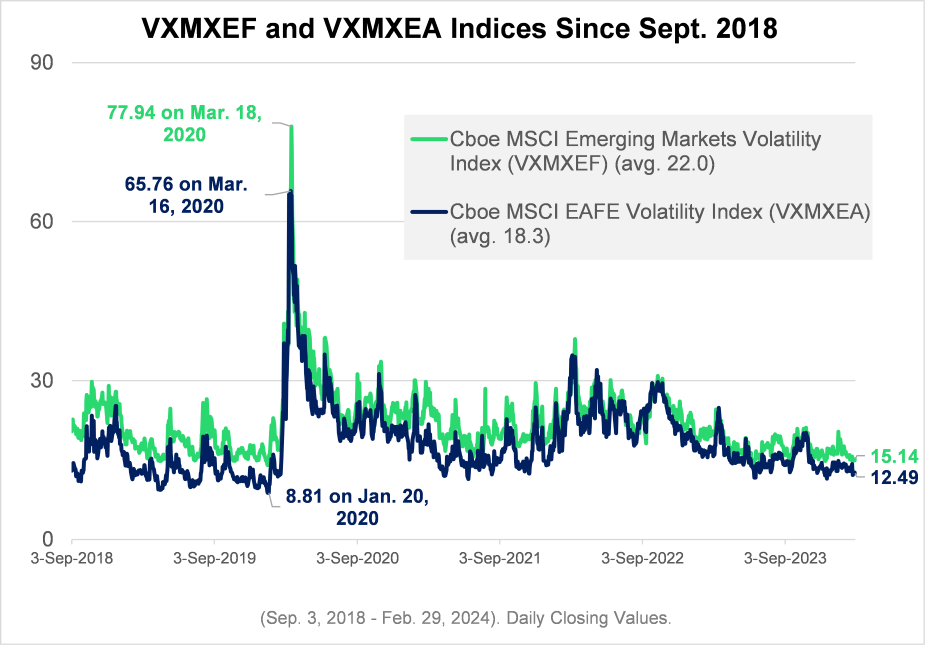

As shown in the chart below:

- AVERAGE VALUES - The average daily closing values were 22.0 for the VXMXEF Index and 18.3 for the VXMXEA Index. The average daily closing value for the VIX Index during the same time period was 21.0.

- HIGHEST VALUES - The highest daily closing value for the VXMXEF Index was 77.94, followed by 65.76 for the VXMXEA Index. Both these high values occurred in March 2020, at the height of uncertainties around the Covid-19 Pandemic.

- LOWEST VALUES - The lowest daily closing value for the VXMXEF Index was 13.95 and 8.81 for the VXMXEA Index.

- LARGE MOVES – In early 2020, the VXMXEA Index increased 646%, rising from 8.81 on January 20 to 65.76 on March 16. Volatility indices often experience sharp swings; the VXMXEF Index rose more than 30% on 5 days and the VXMXEA Index rose more than 30% on 7 days.

Source: Cboe Global Indices

Big Moves, Convexity and Negative Correlations

The VXMXEF Index rose more than 30% on 5 days and the VXMXEA Index rose more than 30% on 7 days. On most of these dates the corresponding stock indices experienced declines.

For example, on March 12, 2020, when uncertainties and fears regarding the Covid-19 Pandemic were increasing:

- The MSCI EAFE Index (MXEA) fell 2.4%, and the MSCI Emerging Markets Index (MXEF) fell 6.7%.

- The VXMXEA rose 45.9% and VXMXEF rose 46.8%.

Some volatility indices have experienced some large moves, convexity in returns and negative correlations versus the returns of the underlying stock indices.

Source: Cboe Global Indices

Source: Cboe Global Indices

To learn more, please visit the links below:

- Index histories and methodologies are available at Cboe’s VXMXEA Index webpage and VXMXEF Index webpage

- Cboe MSCI Option Benchmark Analysis – Harvesting Premiums and Cushioning Multi-Currency Risk to Improve Diversification

More Information

Learn more about Cboe Global Indices and related options and futures strategies:

- Cboe Global Indices

- Income Generation Strategies

- Portfolio Protection Strategies

- Cboe’s Insights Webinar Series Replays

- Cboe 2024 Risk Management Conference in Utah (October 15 – 18)

- Global Option-Writing Strategies to Reduce Risk and Enhance Income (White Paper by Wilshire)

- The VIX® Index and Volatility-Based Global Indexes and Trading Instruments - A Guide to Investment and Trading Features (White Paper)

- Data and Access Solutions

There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2024 Cboe Exchange, Inc. All Rights Reserved.